Li Bin, founder of Weilai Automobile, explained the top ten questions after listing: We are not Tesla of China.

Boots landed, and on September 12th, NIO, a China electric vehicle startup, went public in the United States and rang the bell, becoming the second pure electric vehicle company listed in the United States after Tesla.

Weilai Automobile announced its initial public offering of 160 million shares of american depository receipts (ADS) on the NYSE at a price of US$ 6.26 per share of american depository receipts (ADS), with the stock code NIO, and the total amount raised was about US$ 1 billion.

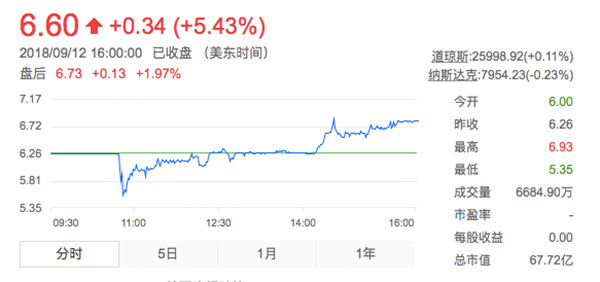

On the trading day, Weilai’s share price experienced a violent shock, with an intraday decline of 13%, and finally closed at 6.6 USD/share, up 5.43% from the issue price, with a total market value of 6.772 billion USD.

Li Bin, founder and CEO of Weilai Automobile, holds about 149 million shares of Weilai Automobile, accounting for 17.2% of the total share capital. According to the closing price of US$ 6.6, Li Bin’s net worth has increased by more than US$ 980 million (about RMB 6.7 billion) since Weilai went public.

Twelve Weilai car owners took the stage as representatives to ring the bell.

At the ceremony, Li Bin invited 12 car owners to ring the bell, but a group of senior executives of Li Bin and Weilai Automobile did not take the stage. The lineup of 12 car owners is also luxurious, including Wu Yibing, co-president of Temasek China, Cheng Tian, partner of Shunwei Capital, Yu Long, CEO of Bertelsmann China Headquarters, Per-Vergard Nerseth, senior vice president of ABB worldwide, and Christer Jansson, vice president of Bosch North American mainframe sales, etc. Among the 12 people, there are Weilai investors, supplier partners, Weilai employees and ordinary car owners.

It took less than four years from its establishment in 2014 to its successful listing in the United States. Star entrepreneurs such as Ma Huateng, Liu Qiangdong, Lei Jun and Yu Minhong are all early investors of Weilai, and the endorsement of the big boss made this new car-making enterprise feel at home in the financing market in the early days. Over the past three years, it has raised 2.4 billion US dollars. At the same time, the net loss also exceeded 10.9 billion yuan (about 1.6 billion US dollars).

On the other hand, Weilai’s first pure electric SUV, Weilai ES8, has just entered mass production delivery in the first half of this year. However, the current production capacity is still in a difficult climbing stage, and there are still big doubts about the company’s production delivery and future profitability.

It can be seen that Weilai urgently needs the capital market to stop bleeding. Listing is a new beginning for Weilai, but there are still more problems to be solved in the future. After the listing ceremony on September 12th, Li Bin was interviewed by the media including The Paper (www.thepaper.cn) reporter, and answered the questions concerned by the outside world one by one.

Question 1: Is the issue price too low?

Previously, Weilai’s prospectus showed that the guiding price range was 6.25-8.25 USD/share, and the actual issue price was only 1 cent higher than the lower pricing limit. According to this pricing, the market value of Weilai is 6.4 billion US dollars, while the previous valuation given by the organization is between 8 billion and 8.5 billion US dollars.

A screen showing the stock price of the NYSE before trading.

Why choose the lower-end pricing? Li Bin told The Paper that this is a decision based on the current market situation and the consideration of bringing long-term returns to investors. However, from the perspective of investors’ orders, we still have more than several times of coverage, which should be in the institutional investors’ field, and we are still very recognized for the achievements and value of our company.

"We could have made a more positive pricing." Li Bin said, "But we do consider the general trend of the market, especially the overall performance of Hong Kong stocks, A shares and US stocks. We still hope to give new investors enough goodwill and respect. In any case, we still hope to have a good price return for all those who support Weilai."

Question 2: Is $1 billion enough?

Before the listing, Weilai had completed the financing of $2.4 billion, and the remaining funds in the account were $600 million. Over the past three years, it has raised 2.4 billion US dollars. At the same time, the net loss also exceeded 10.9 billion yuan (about 1.6 billion US dollars).

The amount of funds raised by Weilai’s listing is about $1 billion. According to the speed of spending money for more than three years, it seems that $1 billion can’t last long.

In this regard, Li Bin said that in addition to equity financing, other financing methods will be strengthened in the future. "We used to be so small that we can finance so much money. Now we are a listed company, and our fundraising ability will definitely be stronger. We have also obtained a lot of long-term investors’ support."

Question 3: Why do you want to donate shares to set up a user trust fund? How to operate?

When Weilai disclosed the prospectus, Li Bin announced in an open letter that he would set up a user trust fund with one-third of the shares held by individuals and about 50 million shares, so that all Weilai users could discuss how to use the economic benefits of these shares.

Li Bin revealed that the original intention of making this decision was to let users not only have a sense of participation, but also have a sense of ownership of the company in some form, but the specific plan is still under study.

"Of course, the establishment of this fund still needs some legal procedures to be completed. It is expected that all the procedures will be completed in the next 6-7 months." Li Bin said, "This is a long-term arrangement, and it will take a long time to see the significance of this system, but we must take this step first anyway."

Question 4: How to deal with delivery difficulties?

At present, car delivery is the most concerned issue for Weilai. According to the data in the prospectus, as of August 31, 2018, ES8 has produced 2,399 units and delivered 1,602 units. At present, there are still 14376 orders waiting to be delivered, and the delivery rate is only 10%.

According to the latest data provided by Weilai, in June this year, the output of ES8 was 272 units and 100 units were delivered. In July, 831 units were produced and 381 units were delivered; In August, 1,296 units were produced and 1,121 units were delivered. The capacity climbing and delivery speed are increasing rapidly.

However, the risk warning in Weilai prospectus also mentioned that 1,700 parts used by Weilai ES8 come from more than 160 suppliers, many of which have only one supplier. Once there is a shortage of components, it will increase the risk of potential delivery failure.

"In fact, the supply chain is the biggest uncertainty for all auto companies." On the improvement of delivery capacity, Li Bin told the reporter of The Paper (www.thepaper.cn) that Weilai is a start-up company. At the beginning, it didn’t have many choices on partners, so the new company will face greater pressure, but in the long run, it hopes to establish a partnership with suppliers.

Question 5: How far is Weilai from profit?

Weilai’s first production car ES8

The question of how Wei Lai makes money is probably the most frequently asked question by Li Bin in public this year. He constantly stressed that Weilai is still a company in the investment period. For such a company, we should pay more attention to the efficiency of R&D expenditure, the construction of user service system, and the position of the company in the market. "We are still a three-year-old child, so it is unreasonable for you to ask him to earn a salary." Li Bin said.

Li Bin said that there will be a reasonable gross profit margin in vehicle sales in the future, and there is still room for further improvement after large-scale production, at least to the level comparable to mainstream luxury brands. In terms of supporting services, Weilai’s long-term goal is to achieve balance of payments.

"The wool is on pigs, and we won’t do such a thing, because it will hurt the user experience, but of course we still need to have a reasonable gross profit in our own car products, otherwise the company can’t develop." Li Bin said.

As for the future sales forecast, Li Bin said that he dare not make such a prediction now: "Musk will suffer this loss. He always tells the plan and is often beaten in the face. We have also had such a lesson. We should be careful not to bring disgrace to oneself in the future."

Although there is no specific sales forecast, in Li Bin’s view, to achieve his ideal scale, the annual sales of 100,000 vehicles and the market holding of 200,000 vehicles are good scale effects.

Question 6: Has Softbank ever gone back on its word and withdrawn its capital?

After the news of listing came out, The Wall Street Journal reported in April this year that Japan’s Softbank Group was in contact with Weilai and planned to buy about $200 million worth of shares after Weilai’s listing. Then it was reported that Softbank withdrew this investment plan on the eve of Weilai’s listing.

In response to this rumor, Li Bin said: "At least in IPO, Softbank has never been within our scope, nor is it the style of Softbank investment. As for whether there are other contacts, it is another matter, but again, I think everyone may be misled by many unrealistic news. "

Question 7: What is the expectation of the stock price?

On the first day of trading, Weilai didn’t start trading until one and a half hours after the opening. The opening price was $6.00, which fell by more than 13% in intraday trading. It was not until the afternoon that the stock price began to climb. The highest transaction price was close to $7, and it finally closed at $6.6/share, which was 5.43% higher than the issue price.

The trend of Weilai stock price on the first day of trading

Li Bin doesn’t seem to care much about the stock price: "Public companies, the stock price rises and falls, I am more concerned about the progress of the business." He said that the stock price is determined by many uncontrollable factors: "I don’t know whether the Federal Reserve will raise interest rates or not, and whether the People’s Bank of China will lower the RRR. It’s not our decision, but what we can do is to do a good job in business and the company. Of course, we will have more exchanges with investors, but we really don’t care about the stock price. "

Question 8: Are you worried about employees cashing out after IPO?

The Paper reporter learned that after the listing, all Weilai employees got the original shares, which were realized in the form of options, and the lock-up period was four years.

When it comes to listing, will you worry about employees cashing out and leaving? Li Bin said with a smile: "Our share price is not very high. If it is high enough for everyone to rely solely on stock returns, there is no need to work. It is really OK to take money and leave. However, it seems that our share price is not as high as that now, and we still need everyone to work hard together, so I am not so worried. "

Li Bin said that Weilai will normally implement the option plan, and the core of Weilai really values the value of enterprise development, and the stock price will not affect everyone’s enthusiasm for work.

From the perspective of executive stock ownership, Li Bin is not stingy with venture partners, and many executives have benefited a lot from Weilai’s listing. According to the prospectus, Wei Lai co-founder Li Xiang holds 15 million shares, with a share of 1.7%; Wu Sili, CEO of Weilai North America, holds about 11.79 million shares, accounting for 1.4%; Qin Lihong, co-founder and president, also got less than 1% of the shares.

Question 9: After ringing the bell twice in eight years, what is the biggest change?

For Li Bin, this is the third time in his life that he has experienced the ringing of the listing bell. Eight years ago, it was also listed on NYSE, BITA (stock code: Bita), raising $127 million, becoming the first car internet company in China to be listed overseas. Li Bin founded Easy Car Company in 2000, and in just a few years, it has developed into the leading Internet car information platform in China.

In the photo taken after the bell ringing ceremony of Easy Car on November 17th, 2010, Shao Jingning, then president of Easy Car (now founder of Xingyuan Automobile), stood on Li Bin’s left, and Zhang Xu ‘an, CEO of Easy Car Company and founder and CEO of Yixin, stood on his right.

Yixin is an automobile trading platform hatched by Easy Car Company, which was listed in Hong Kong stock market in November 2017. On the day of listing, Li Bin also arrived at the scene. In the photo taken at the scene, Li Bin and Zhang Xu ‘an are still standing together, and their faces have added many vicissitudes.

Talking about the feeling of ringing the bell for the second time, Li Bin admitted that he was not as excited as he was in the first time. "Listing is certainly an important milestone for a company, but it is only a milestone. We know that there are still many challenges ahead. The mood is definitely a little different. "

Li Bin, who started his business continuously, successfully landed two companies in the capital market. Facing the drastic global economic environment, Li Bin said frankly that he hasn’t changed much except for more white hair. However, from the external environment, when Easy Car went public, the American capital market still had a great sense of freshness for China companies. Now, we will see China Stock Exchange more pragmatically, and the market sentiment has changed.

At present, in Li Bin’s resume, he is not only the founder of two listed companies, but also an investor in many star startups, the most famous of which is mobike, who just sold it to Meituan for a total price of $37 this year.

Since 2014, relying on Easy Car, Li Bin has invested $400 million intensively in 32 service products and startup companies related to transportation, including many star projects such as mobike, Didi Carpool, Youxin Used Car, Electric State, ETCP Parking, etc., and basically covers automobile-related fields and industries such as automobile media, automobile e-commerce, vehicle manufacturing, automobile aftermarket, mobile travel service and automobile peripheral service. Therefore, the outside world gave Li Bin the title of "godfather of travel".

Question 10: Is Weilai the next Tesla?

In 2010, Tesla was listed at a price of $17, and its share price once surged to $379.57, and its market value once surpassed that of traditional car companies such as GM and Ford. Obtaining a higher valuation from the outside world may be one of Weilai’s expectations for this US stock listing.

Weilai, which is also positioned as a high-end pure electric vehicle, is inevitably compared with Tesla. Even Weilai’s development track so far has many similarities with Tesla-both companies first launched extreme products that can show their technical strength at the beginning of their establishment to "show their muscles": Weilai has an electric supercar EP9, and Tesla has the earliest sports car Roadster;; The first mass-produced products are aimed at high-end consumers (Weilai ES8 and Tesla Model 3), and then more popular products (Weilai EP6 and Tesla Model 3) are introduced; Both companies are also going through the stage of burning money and losing money.

Weilai is often called "Tesla of China", but Li Bin doesn’t think so. "There is no doubt that Weilai and Tesla are completely different companies." His tone is firm: "Look at Weilai’s concept, design and innovation about experience, and it is easy to find that Weilai and Tesla are completely different companies, not even companies of the same era. These can only be proved by time. "

"Our expectations for ourselves are definitely not simply to be a’ Tesla of China’, we are a’ Weilai of the world’." Li Bin said.

The Paper reporter noticed that Baillie Gifford, the major shareholder of Tesla, is also one of Weilai’s investment institutions. Li Bin said that he believes that he can get the investment from Baillie Gifford, which shows that many foreign institutional investors can see the same innovative will and innovative power in the business model as Tesla in Weilai.

Although Tesla’s share price has soared, the company’s profit performance is not good. Tesla’s financial report shows that in the second quarter of this year, the company’s revenue was US$ 4.002 billion, and its net loss was US$ 717.5 million. Compared with US$ 336.4 million in the same period last year, the loss was further expanded.

Elon musk, the founder and CEO of Tesla, proposed to privatize the company for the first time last month, eight years after listing, although he soon announced that he had given up the idea. Since the beginning of this year, Tesla has suffered setbacks one after another-Model 3 production capacity has been blocked, losses have increased, cash flow has been tight, and credit rating has been downgraded … In addition, some outrageous actions and remarks by Musk himself have made it worse, and the outside world’s doubts about it are getting louder and louder, and Tesla’s prospects are not clear.

Will Tesla’s today become Weilai’s tomorrow? There is no answer to this question yet. At the end of the interview, Li Bin smiled and told reporters that at least he would not become Musk, "because I don’t smoke, drink or tweet."