Concept of R&D activities

Clarifying the concept of R&D activities is helpful to correctly understand and grasp the policy of adding and deducting R&D expenses.

1. Definition of R&D activities in terms of science and technology

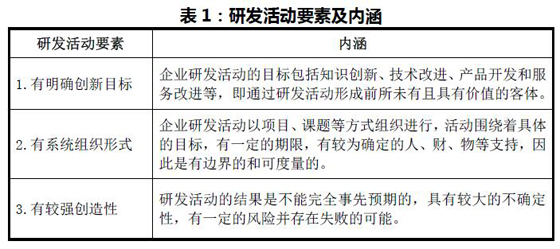

Enterprise R&D activities refer to activities with clear innovation objectives and systematic organization forms but uncertain R&D results (see Table 1).

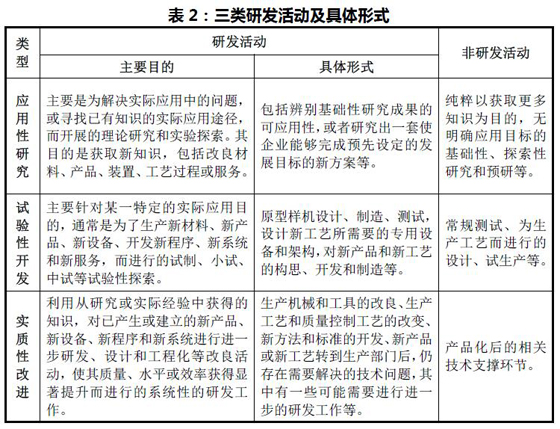

OECD’s Manual of Research and Development Investigation and Frascati Manual divide R&D activities into three categories from the dimension of R&D nature (see Table 2):

2. Accounting definition of R&D activities

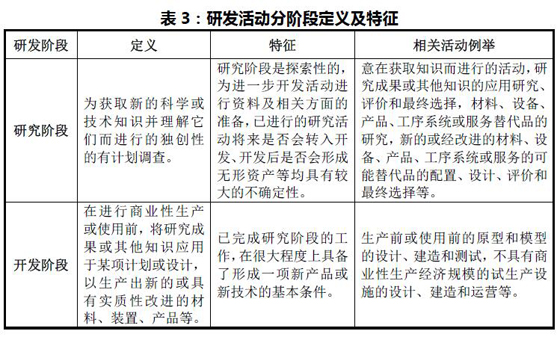

Accounting Standards for Business Enterprises No.6 — — Intangible assets and its application guide (2006 edition) stipulates that the expenditure of internal research and development projects of enterprises should be distinguished from the expenditure of research and development, and should be included in the current profit and loss when it occurs. Enterprises should judge according to the actual situation of research and development, and divide research and development projects into research stage and development stage (see Table 3).

The Accounting Standards for Small Enterprises does not specifically define R&D activities. According to the first paragraph of Article 3 of the Accounting Standards for Small Enterprises: "For small enterprises that implement the Accounting Standards for Small Enterprises, transactions or events that are not regulated in these Standards can be handled with reference to the relevant provisions in the Accounting Standards for Business Enterprises", so it can be implemented with reference to the definition of the Accounting Standards for Business Enterprises.

According to the Accounting System for Enterprises, research and development activities refer to the activities of enterprises to develop new products and technologies. The purpose of research and development activities is to substantially improve technologies, products and services, and transform scientific research achievements into innovative products, materials, devices, processes and services with reliable quality, feasible cost.

3. Definition of R&D activities in terms of taxation

The document Caishui [2015] No.119 defines the R&D activities of enterprises. R&D activities refer to systematic activities with clear objectives that enterprises continue to carry out in order to acquire new scientific and technological knowledge, creatively apply new scientific and technological knowledge, or substantially improve technologies, products (services) and processes.