Six questions about the property market: Can the increase in house prices hit a 79-month high and limit purchases and loans be effective?

BEIJING, Beijing, September 20 (Cheng Chunyu) In August, house prices in 70 large and medium-sized cities across the country rose again, and the price of new houses rose to a new high of nearly 79 months. Why did house prices rise again in August? Which cities have risen sharply? What is the effect of restricting loans and purchases in cities? Is the current house price overheated? Will there be any changes in future policies? The reporter interviewed industry research institutions and experts to interpret this one by one.

What is the difference in the trend of house prices in August?

The month-on-month increase hit a new high of nearly 79 months.

Statistics of residential sales prices in 70 large and medium-sized cities in August released by the National Bureau of Statistics on the 19th show that both the month-on-month price increase and the year-on-year price increase in cities in August. The prices of newly-built commercial housing and second-hand housing rose by 64 and 57 respectively, 13 and 6 more than last month.There are 31 cities where the price of newly-built commercial housing has increased compared with last month, and 30 cities where the price of second-hand housing has increased compared with last month.

According to the latest report of the think tank center of Yiju Research Institute, in August, the price of new commercial housing in 70 large and medium-sized cities increased by 1.3% from the previous month. The price index of new commercial housing in first, second and third tier cities increased by 3.4%, 1.7% and 0.6% respectively, and the growth rates of the three types of cities all expanded, with the first-tier cities expanding the most obviously. The price index of new commercial housing in first, second and third tier cities increased by 30.5%, 10.3% and 2.5% year-on-year, respectively, and the growth rates of the three types of cities all increased.

Yan Yuejin, research director of the think tank center of Yiju Research Institute, pointed out that the average month-on-month increase in the price of new commercial housing in 70 large and medium-sized cities hit a new high of nearly 79 months, which is the highest month-on-month increase since February 2010.

Which cities have seen the biggest price increase?

Six cities including Zhengzhou and Shijiazhuang may continue to lead the gains.

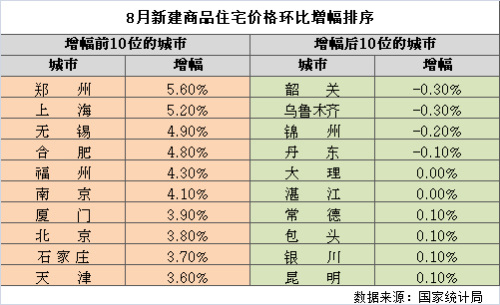

In August, the price of new commercial housing in 66 of 70 cities rose or stopped falling. Among them,The five cities of Zhengzhou, Shanghai, Wuxi, Hefei and Fuzhou have the largest increase in house prices. Nanjing, Xiamen, Beijing, Shijiazhuang and Tianjin have also increased significantly, ranking among the top 10. The price increase of new commercial housing in Shaoguan, Urumqi, Jinzhou, Dandong, Dali, Zhanjiang, Changde, Baotou, Yinchuan and Kunming ranked in the bottom 10.

Xie Yifeng, a real estate expert, said in an interview with Zhongxin. com (WeChat WeChat official account: cns2012) that in August, housing prices in the first, second and third tier cities in 70 cities generally rose, and the trend of second-tier cities replacing first-tier cities and third-tier cities was obvious.In August, Zhengzhou house prices replaced Suzhou, Xiamen, Hangzhou and Nanjing, the former "four little dragons", leading the country. In the future, the housing prices of Zhengzhou, Shijiazhuang, Tianjin, Fuzhou, Jinan and Wuxi, the "six little dragons", are expected to take the lead..

What pushed up house prices in August?

"Capital Tide+Asset Shortage" Triggered the upsurge of buying houses.

Zhang Dawei, chief analyst of Zhongyuan Real Estate, believes that,The reason for the outbreak of housing prices now is the shortage of assets under the tide of funds, which has triggered a wave of buying by buyers. This trend continued until the beginning of September, and there was a wave of buying again in many places, and the transaction obviously warmed up.

According to data released by the central bank, mortgage accounts for more than 50% of new loans for two consecutive months. In August, new loans in RMB reached 948.7 billion yuan, and the new loans in the household sector reached 675.5 billion yuan, an increase of 47.65% from the previous month. In July, RMB increased loans by 463.6 billion yuan, of which loans from households increased by 457.5 billion yuan.

Yan Yuejin also believes that after the rise in housing prices in the second quarter, the housing value of the first home buyers increased rapidly, and the improved demand was quickly released. At the same time, due to the vague understanding of potential buyers on the follow-up direction of the policy, it triggered a wave of buying in the property market in August, pushing up housing prices. It is suggested that when policies are issued in subsequent localities, the confidentiality of meetings should be strengthened to prevent all kinds of rumors from appearing, so as to stabilize market expectations.

What is the effect of restricting loans and purchases?

In August, the loan restriction was implemented, and the price increase in the two cities expanded.

The reporter combed and showed that outside the first-tier cities, Suzhou (implemented on August 12), Xiamen (implemented on September 5) and Hangzhou (implemented on September 19) have restarted the purchase restriction policy. In addition, Hefei (implemented on August 9), Nanjing (implemented on August 12) and Wuhan (implemented on September 1) have introduced loan restriction policies.

Yan Yuejin said,In addition to the cities that have issued policies, Fuzhou, Tianjin, Wuxi, Jinan, Qingdao, Nanchang, Huizhou, Kunshan and other cities will limit the possibility of purchasing or lending in the future..

According to the data released by the Bureau of Statistics, although Hefei and Nanjing implemented the policy of restricting loans in the first half of August, the prices of new houses in the above-mentioned second-tier cities (excluding Suzhou) continued to rise in August, with the month-on-month increase exceeding 3%. Among them, the growth rate of Nanjing, Hangzhou, Hefei and Wuhan increased month on month. Suzhou, which is not within the statistical range of 70 large and medium-sized cities, experienced a month-on-month decline in house prices. According to data from China Index Academy, in August, house prices in Suzhou fell by 0.25% month-on-month.

Xie Yifeng believes that there is no possibility of a sharp drop in house prices and transaction volume in cities with restrictions on purchases and loans in the short term.At present, the policy control efforts introduced in various places are generally relatively gentle, and there is no combination boxing, which can not smooth the fluctuation of supply and demand for the time being, and can not solve the phenomena of insufficient housing inventory, concentrated resources and asset shortage.

How to go in the future?

It is difficult to restrain the rise of house prices, so we should be alert to the risk of overheating.

Yan Yuejin said,Based on the fact that there is a serious shortage of saleable housing in first-tier cities at present, the subsequent housing prices will continue to rise, and it is still a difficult task to curb the housing price increase; Second-tier cities have similar logic, with a large increase; Third-tier cities continue to rise slightly.Cities such as Wuxi are the cities that have risen rapidly in this round of third-tier cities.

Zhang Dawei believes that under the current capital tide, the impact of restrictions on purchases and loans in many cities such as Hangzhou on the market is very weak, and it is still a trend that house prices will continue to rise sharply without tightening the credit line of real estate.

"The policy will really land and affect transactions until the first half of next year, during which the risk of overheating of housing prices is worthy of vigilance." Yan Yuejin believes that the national housing prices entered the "overheated" range in April, returned to the "overheated" range from May to July, and returned to the "overheated" range in August. Overheating house prices will cause new problems, such as increasing the risk of mortgage asset bubbles and distorting the wealth distribution mechanism of people with and without houses.

Will the property market regulation policy change?

Experts expect to enter the coexistence stage of "destocking and controlling house prices"

Zhang Dawei believes that controlling housing prices requires three overweight policies — — Reduce the tide of funds, increase high-quality assets, and reduce the panic of buyers. It is expected that real estate regulation will continue to be "based on the city" in the future. In order to destock real estate in third-and fourth-tier cities, banks are advised to increase interest rate concessions for third-and fourth-tier cities.

Xie Yifeng believes that if the property market in the second-tier cities that have introduced tightening policies continues to have a high fever, the local authorities will definitely regulate and overweight. The most likely combination of policies is to increase the down payment and interest rate of mortgage loans, upgrade the conditions and standards for restricting purchases and loans, cancel tax incentives, tighten the credit of housing enterprises, and crack down on third-party mortgage platforms.

“Credit tightening is a high probability event, but it will definitely not be tightened for the first set, and it is inevitable for the second set. It is expected that the source of down payment funds will be severely reviewed in the future.Yan Yuejin said that in the future, the policy level will enter a special state, that is, the stage of "destocking and controlling house prices". Major provincial capital cities and hot-spot third-tier cities need to adopt the way of controlling house prices in urban areas and actively destocking in suburbs. (End)