Data speak: to develop, we must also understand development.

These days, with the approach of the National People’s Congress and the announcement of GDP growth targets in 2024,China’s economic prospects this year.The discussion has become much more.

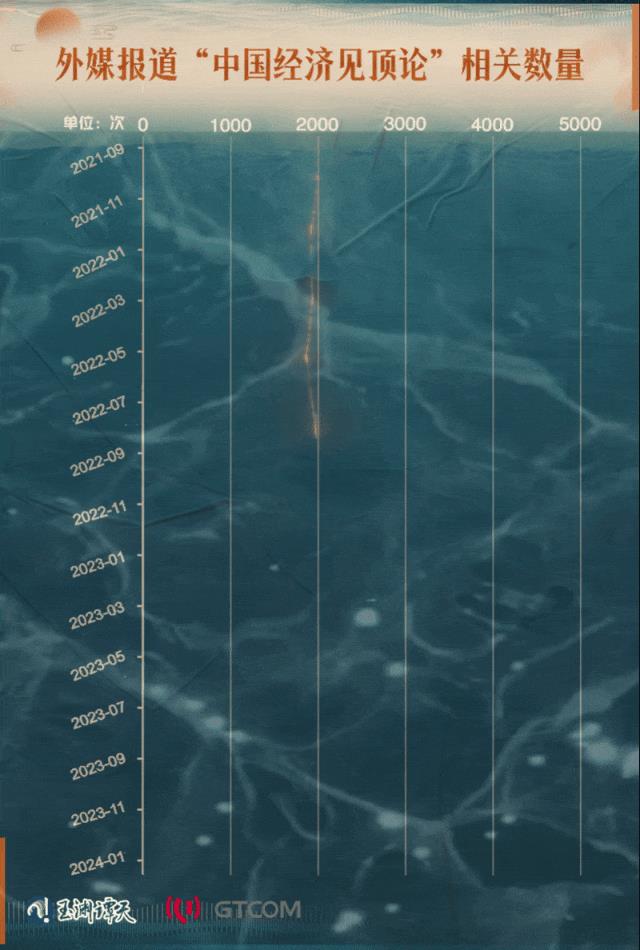

But Tan Zhu also noticed that, for example, "China’s economy peaked"confuse the publicThe voice, mixed in the discussion.

Everyone’s discussion about China’s economy needs to be answered. If you want to answer this question, you mustCorrect understandingThe development of China.

Master Tan also wants to talk about his own understanding of China’s economy.

In today’s globalization, China’s economy is more placed inIn the context of the worldTo discuss.

Since China becameThe world’s second largest economySince then, the ratio of China’s GDP to that of the United States has always been the focus of discussion.

In 2023, this figure was somewhat higher.descendSeeing this change, combined with the United States’ high-tech field in China in recent years,Blockade and suppressionMany people think that China’s economy is going under pressure."downhill"Yes.

In fact, is that right?

Let’s first return to this numerical indicator itself and do it.Accounting of total GDPIt also involves factors such as prices and exchange rates.

Let’s talk about prices first. When countries do gross GDP accounting, they useNominal GDP calculated at current local currency priceThis needs to be considered.priceThe factors. In the past three years, the United States has adopted radical fiscal and monetary policies, resulting inThe United States is caught in high inflationSituation, this alsodrasticallyIt has raised the nominal GDP scale of the United States..

Take 2022 as an example. In 2022, the CPI and PPI of the United States were respectively year-on-year.Growth of 8% and 16.5%In contrast, in 2022, China CPI and PPI were respectivelyUp 2% and 4.1%. Among them,"Gap" in Numerical Calculation, you can imagine.

But the growth of GDP, in the final analysis, mustSolve the problems of our own peopleThe American people have the most say in making their own people have a sense of gain and happiness. Under high inflation, whether such growth has a sense of gain or not — — Recently, the United States entered the election cycle.Inflation problemIt is still one of the most concerned topics for the American people.

The monetary policy and fiscal policy of the United States will always be adjusted. Looking at it in a long period, the current fiery heat isTemporary and phased.

In addition to prices, we also need to consider when comparing economic aggregates.exchange rate— — The comparison of China-US economic aggregates should be based on the scale of China’s GDP denominated in RMB.Convert into dollars.

In the past two years, the United States has entered a new cycle of raising interest rates. From March 2022 to July 2023, the Federal Reserve hasRaise interest rates for 11 consecutive times, the cumulative rate hike is up to525 basis points, yesFor more than 20 years,United States of AmericaSteepalsoThe most radicalA rate hike.

Interest rate hikes usually bring about a net inflow of international capital.Push up the dollar exchange rate. The RMB exchange rate is from March 2022.US$ 1 to RMB 6.3 yuan, came to today’sUS$ 1 is about RMB 7.1 yuan.. The exchange rate is also objective.LalaThe calculation of the "gap".

These are all factors to be considered when comparing the economic aggregates of economies.

Not long ago, The Wall Street Journal reported that in 2008, the economies of the United States and the euro zone.On a comparable scaleBut now, the economy of the United States is almost that of the euro zone.2 times. The Wall Street Journal used this data to prove that the American economy is better than the European economy.

This report was criticized by American economist Krugman, who said that this is mainlyThe euro depreciated against the dollar.The result of — — In 2008, the exchange rate of the euro against the US dollar reached its highest level.1.59In 2023, this number has depreciated to1.05.

It stands to reason that such factors should also be considered when comparing the GDP between China and the United States. But interestingly, after seeing the phenomenon that the ratio of China’s GDP to that of the United States has declined, Krugman wrote this in another article of his own:

China’s economy is in serious trouble.

When discussing other economies, consider other factors objectively. When discussing China, it means that China’s economy will collapse and "peak".

In fact, this is not just Krugman’s voice.

Looking back at earlier history, the first concept that was hyped up was"middle income trap".

Around 2010, a World Bank report pointed out that in 1960101 middle-income economiesBy 2008.There are only 13Become a high-income economy, the rest of the countries and regions continue to stay in the middle-income stage, and some even fall to low-income economies. Therefore, economists put forward the concept of "middle income trap".

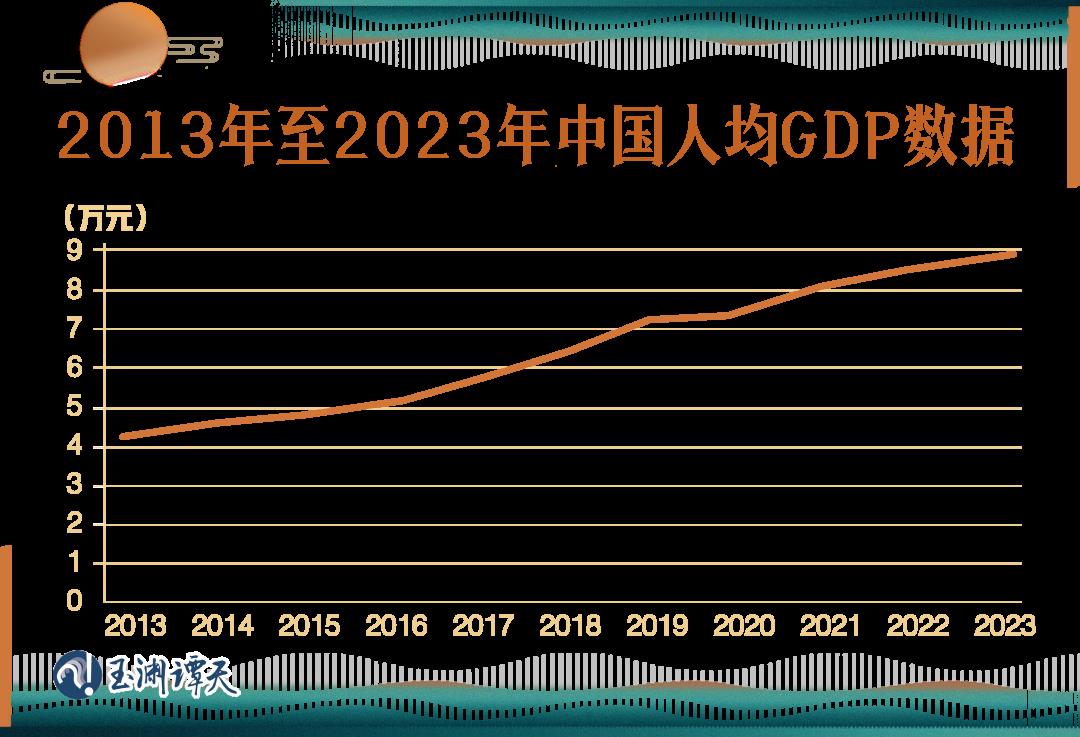

At the same time, China’s per capita GDP reached.Above-average level, andKeep it around 7%The steady growth rate.

In this regard, some people began to speculate whether China will also fall into the "middle income trap". China’s economic data are compared with those of Brazil, Argentina and other countries.

At that time, these people caught a node,The global economic situation is in a downward cycle.— — Because a large part of the countries caught in the "middle income trap" are becauseUsed to rely on exports.In the period of slowing global demand, it naturally appears.Slow or stagnant growthThe phenomenon.

When this narrative is applied to China, it becomes that China’s success was due to the downwind. At present, China is in aNew supercycleAnd this is aDownlink cycle.

Specifically, in the past, China’s economy was on the cusp of globalization. Now, the cusp has disappeared. The higher China stood before, the worse it will fall.

The fact is, in the same year that the "window" of hype globalization disappeared,China has become the world’s largest trading country in goods., has also becomeThe firstTotal trade in goodsMore than $4 trillionThe country.

Subsequently, China used development to make the narrative of the "middle income trap" gradually weaken. With these years of development, we haveClose to the threshold of high-income countriesThe trap didn’t stop us from moving forward.

But at the same time, the new narrative, againIn the same routineBe fired. China wants to talk to Indian.Specific population, and the United StatesSpecific total quantity, and VietnamSpecific growth rateThe conclusion of each comparison is that China’s economy will "peak".

What is the purpose of this comparison?

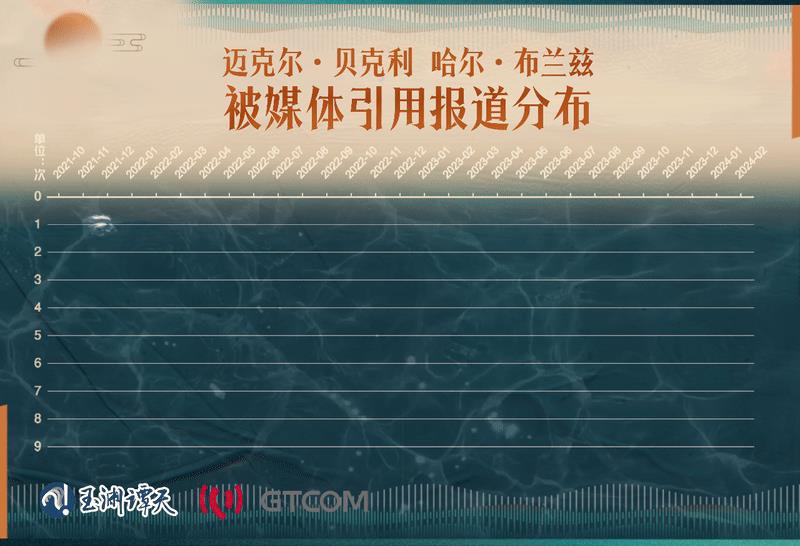

After searching for keywords such as "China economy" and "peak", Tan found the main proponent of "China’s theory of economic peaking".

One is Hal Brands of Johns Hopkins University in the United States, and the other is Michael Beck Leigh, a professor at Tufts University. Their status in the university isPolitical scholarThere is no background in the economic field. On the contrary, both of them have.existThe US Department of Defense and the National Security Department serve or provide advice.Experience.

Michael used a geopolitical concept — —"peak power trap" (peaking power trap)To annotate "China’s economic peaking theory". Michael’s intention is to compare China with other great powers in history, and then make the deduction of "peaked decline".

Obviously, the purpose of comparison is to say that China will become the "risk" of the world. No matter what kind of data, as long as it can demonstrate that China’s economy "peaks", it will beAmplified propagation, can be used as "evidence" that China will bring "risks".

Of course, it is easy to be "slapped in the face" in the way that China’s economy is degraded by a single data. Tan Zhu also found that some people are comparing related narratives through data, which meansThe logic behind itIt is more worthy of our further study.

Some current indicators and trends of China’s economy are similar to those of a certain country. The implication is that China also needs to face the problems faced by this country — — China needs to step on the pit that others stepped on again.

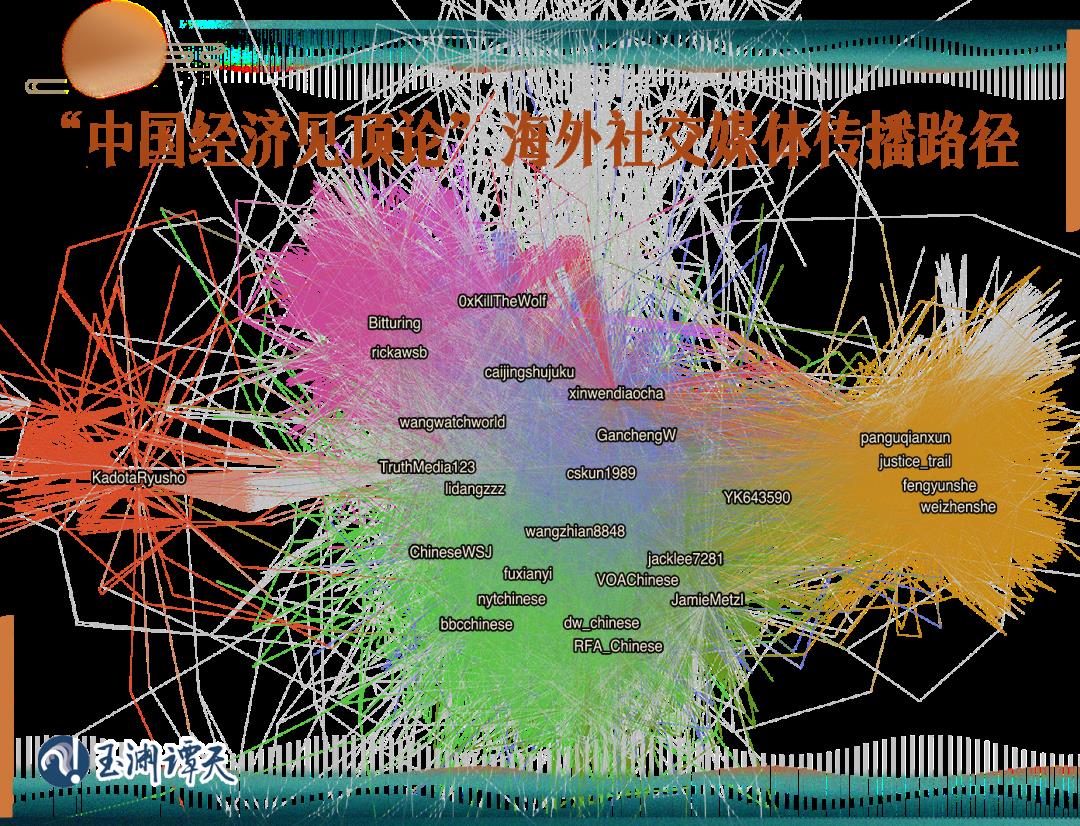

After searching and analyzing the related expressions of "China’s economic peaking theory", Tan found that,Overseas social media, is an important part of the communication link of "China’s economic peaking theory".

Among them, the discussion trend of "China’s economic peaking theory" on overseas social media platform "X" (formerly Twitter) and overseas social forum Reddit and the trend of foreign media reporting "China’s economic peaking theory",Basically consistent.

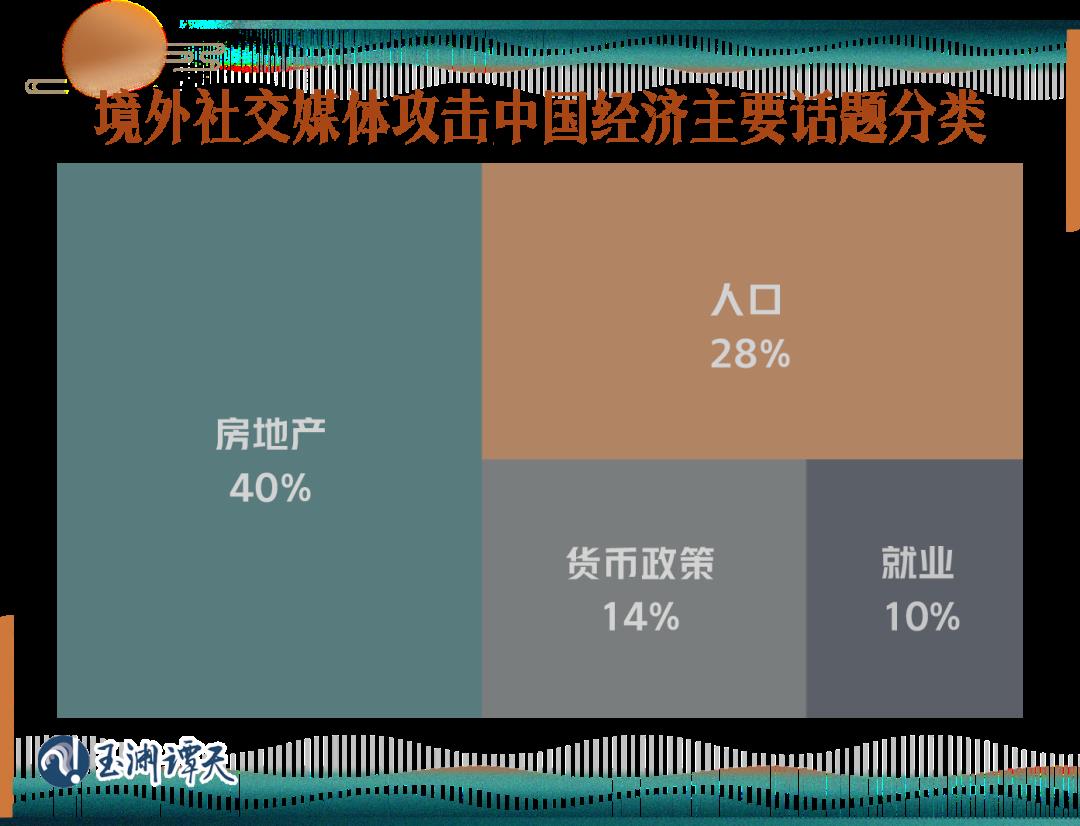

Last January and September.It is these two platforms that sing down China’s economic discussion.The densestIn January, after analyzing the relevant contents, Tan found that,Real estate related topics, accounting for its production of China’s economic-related "point of view"40%, accounting for the most.

Among them, the most mentioned is to associate China real estate market with Japanese and American real estate markets, saying that China is experiencing."real estate bubble".

As a national economymainstay industryWhether the real estate industry can develop healthily is related to whether a country’s economy can run smoothly.

Take Japan as an example. After the bursting of Japan’s real estate bubble, it brought Japan not only a consequence of the sharp drop in asset prices, but also the Japanese economy failed to improve under the stimulation of fiscal policy and monetary policy, and the whole society seemed to also.Lost the "heart".

In this regard, Jin Ruiting, director of the Foreign Economic Research Institute of the National Development and Reform Commission, told Tan Zhu that on the one hand, due to factors such as the rigidity of Japan’s economic and social system and the lack of young people’s willingness to promote, Japanese societyConsumption vitality is shrinking day by day. On the other hand, Japan is highly dependent on the United States in politics and security.Aggressive trade warJapan can only make concessions step by step, resulting in serious losses to the national economy, and advantageous industries are making concessions step by step.Lose competitiveness.

Obviously, foreign media want to ruin China’s economic prospects by constructing the narrative that Japan is a lesson for China.

In fact, is this really the case?

China is still inThe later stage of the accelerated development of urbanization, still hasStimulating domestic demand with urbanizationJapan and China have a large space, whether it is market size or economic potential, or the ability to actively respond to and actively shape the external development environment.Large gapAnd, just sayreal estate industryThe situation in China and Japan is not the same.

Is China really experiencing the bursting of the real estate bubble?

Not long ago, Gao Shanwen, an academic member of China Financial Forty Forum (CF40) and chief economist of SDIC Securities, shared his views. He said that he also noticed that the view that China is experiencing the bursting of the real estate bubble is very popular at present, but after further careful analysis of the data, he believes that many aspects of this view.Worth further scrutiny..

Gao Shanwen analyzed the bursting process of real estate bubbles in Japan, the United States and other countries from two aspects.

The first group isThe proportion of real estate investment in GDP.

||Before the bubble, the proportion of Japanese real estate investment in GDP was8%In the process of foaming, this dataUp to 11%After the bubble burst, Japan spentFor more than 10 yearsEliminate the problem of oversupply, and finally make real estate investment a proportion of GDP.Maintain at around 6.5%.

||Before the bubble, the proportion of American real estate investment in GDP was8%In the process of foaming, this dataRapid riseAfter the bubble burst, the United States spentNearly five years., the proportion of real estate investment in GDPMaintain at around 7%.

The second group is the transaction volume of second-hand houses.

No matter the United States, Britain, the Netherlands or Spain, these countries all appeared after the bursting of the real estate bubble.The phenomenon that the transaction volume of second-hand houses has shrunk dramatically.— — In the process of foaming, the demand has beenBe overdrawn. And this shrinkage is generally inAbout 50%, and willFor five or six years.For a long time

Gao Shanwen believes that China’s housing market is experiencing.Revision of priceInstead of the bursting of the bubble. The so-called bubble refers to a large amount of speculative demand pouring into the market for a period of time, which will lead to an abnormal expansion of supply. After the speculative demand disappears, the enlarged supply will form a surplus.

It is worth noting that there is no obvious oversupply in China. The peak of China’s real estate investment in GDP appeared in 2013, and since then,The proportion of real estate investment has dropped rapidly.By 2024, it may fall toAbout 5.5%.

From the transaction volume level, the bursting of the real estate bubble will lead tospeculative demandsDisappear, part of itNormal demandOverdraft will also disappear, so the transaction volume will shrink rapidly. After trading volume bottoms out, it often takes a long time to recover.

The situation in China is somewhat different. According to the data publicly disclosed by the government, the transaction volume of second-hand houses in China in 2023 isObvious amplificationYes. This is in line with the market adjustment in most cases when the bubble bursts.Very different.

Regarding the situation of the real estate market in China, Dong Jianguo, Vice Minister of Housing and Urban-Rural Development of China, said that from the structural analysis, the contribution of real estate to the macro economy,From incremental pull to stock drive. The increase in the proportion of second-hand housing transactions has a limited effect on upstream industries such as cement, steel and building materials, but it can drive furniture, home appliances and home improvement.Downstream industry development.

Tan Zhu noticed that recently, the local two conferencesFrequently mentioned"Trade-in" and actively cultivate new consumption growth points such as smart homes.

On February 23, at the fourth meeting of the Central Financial and Economic Committee, we also studied the trade-in of traditional consumer goods such as household appliances.Promote the trade-in of durable consumer goods..

These measures are also carried out on the basis of grasping the new situation.New adjustment.

During the adjustment period of China’s real estate industry, new opportunities are also brewing.

To make a simple analogy, the pull of real estate on upstream industries is more like"disposable"Yes, after all, cement and steel will not iterate, but products such as smart home will, and manufacturers will continue to research and develop with the proceeds.Update iterationOwn products. On the one hand, this willCreate more jobsOn the other hand, this will allow consumers toCheaper priceUseBetter products.

Obviously, it is untenable to directly infer a simple conclusion: the real estate market in China will be the same as that in Japan.

From the comparison of data to the comparison of development stages, "China’s economic peaking theory" seems to be only "China’s economic collapse theory"The latest statement.

Is the purpose of advocating "China’s economic peaking theory" just to sing down China’s economy?

The Loy Institute of the United States, which made an economic endorsement for China’s economic peaking theory, once published a report, whichpredictBy 2050, the average annual growth rate of China’s real GDP will beDown to 2%-3%.

The report mentioned such a sentence,of course,It does not rule out the possibility of up to 5%.

So, what are the conditions of this "possibility"? The brief summary isChina economic systemWhether it is "westernized".

Obviously, the ultimate goal of "China’s economic peaking theory" is to compare the advantages and disadvantages of the economic system, thusChange China’s economic system..

Seeing this, we can already understand. Compare to compare, is to let usLose yourself.

Some think tanks have analyzed the "China’s economic peaking theory" from a narrative perspective. Tan found that one of the important narratives is to question China’s economic recovery by using the dichotomy of focusing on investment or consumption.

In practice, what is our logic?

Wang Qing, chief macro analyst of Oriental Jincheng, shared such a set of data with Tan Zhu:

In January this year, household loansAn increase of 980.1 billion. Among them, short-term loans increased by 352.8 billion yuan, and medium-and long-term loans.An increase of 627.2 billion yuanAnd maintained the momentum of steady growth.

Generally speaking, new loans from households reflectResidents’ willingness to consume and the recovery of consumption. This set of data is enough to illustrate the motivation of consumption.Not weak.

Specific to the data of medium and long-term loans, it reflectsLonger-term demand.

Wang Qing analyzed that the new credit in the medium and long term is concentrated in residents’ business loans and medium and long-term consumer loans. Among them, the most concentrated one isAutomobile consumptionBecause automobile consumption has always been a main force of medium and long-term consumer loans.

Car sales in January2.439 million vehicles,Year-on-year growth of 47.9%. And the medium and long-term automobile consumption demand, to some extent,Drive short-term travel consumption.

Six days before the Spring Festival this year, the per capita expenditure of tourism in Henan and Inner Mongolia was higher than that in 2023.Increase by 14.4% and 35.5%The per capita expenditure of tourism in Henan is higher than that in 2019.An increase of 6.4%.

And travel by car, become the absolute mainstream mode of travel. During the Spring Festival, self-driving travel accounts for the proportion of highway personnel flow91.4%In the first 20 days of Spring Festival travel rush, the average daily passenger trips of non-operating passenger cars on highways also increased significantly compared with 2019.

The reality is that China’s consumption potential is still huge in the short term or in the medium and long term. In 2023, the contribution rate of final consumption expenditure to China’s economic growth reached.82.5%.

What supports China’s consumption is not relying on the logic of "throwing money" in the United States and the West, but insisting on structural reform on the supply side, optimizing supply and expanding effective investment at the production end while trying to improve the income and social security level and improve the consumption environment.

For example, the automobile field represents the medium and long-term consumption potential. In the past year, investment in automobile manufacturing increased year-on-year.19.4%It is much higher than the overall growth rate of manufacturing investment. Against this background, the automobile production in January was 2.41 million, a year-on-year increase.51.2%.

Behind the increase in output is more employment and income, which will also enhance consumption power.

Investment and consumption are not only "either-or" choices, but can be balanced.

Yu Yongding, a member of the China Academy of Social Sciences, mentioned that investment has a dual role.Investment not only stimulates economic demand in the short term, but also is the source of future economic growth..

Our confidence in China’s economy does not come from comparing with others, nor from whether it is consistent with others’ logic, but fromWe have our own way of solving problems..

The way that conforms to your own reality and can solve your own problems is the way you should stick to it.

We know that China’s economy has to face many difficulties and challenges, but we have experienced so many difficulties and challenges in these decades. We have been developing in the process of struggling with all kinds of difficulties.

Climbing over the hill, facing problems and solving them are our confidence in China’s economic development.