Just now, the historical record was born! Nearly 30 billion Hong Kong dollars, south to grab Hong Kong stocks!

Today, A-shares fluctuated in early trading and rebounded in the afternoon. The trend of blue-chip stocks in the large-cap market was weak. The Shanghai Stock Exchange once fell more than 1% in the 50-session, while small-cap growth stocks were more active. The North Stock Exchange 50 Index rose more than 2% at most. Rising stocks far outnumbered falling stocks, and the turnover shrank to 1.54 trillion yuan.

The Hong Kong stock market opened lower, with the Hang Seng Index falling nearly 2% and the Hang Seng Technology Index falling more than 3% at most. In terms of sectors, Hang Seng Shipping Theme Index and Energy Industry Index strengthened against the market. The net purchase of southbound funds was HK$ 29.626 billion, the highest net purchase in a single day in history. Li Nian International soared by more than 110%, while Ark Jianke and Jin Chaoyang Group also rose by more than 40%.

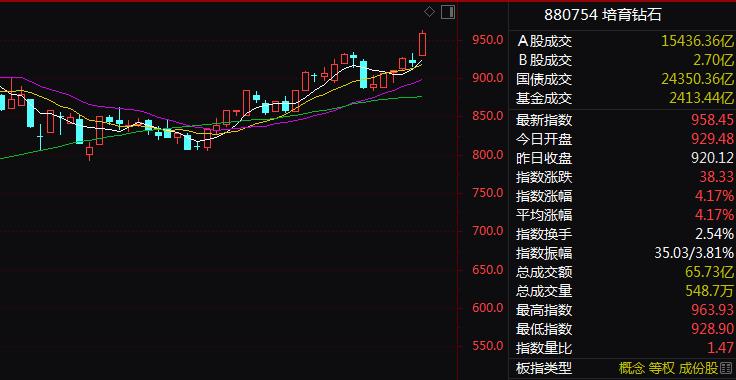

On the A-share market, the sectors of cultivating diamonds, medicine, micro-small-cap stocks and ST were more active, while telecom services, insurance, artificial intelligence and banking were among the top losers.

Real-time monitoring data of Wind data show that machinery and equipment have received a net inflow of more than 4.5 billion yuan of main funds, non-ferrous metals and power equipment have received a net inflow of more than 2 billion yuan, basic chemicals and pharmaceutical biology have also received a net inflow of more than 1 billion yuan, and building materials have received a net inflow for 9 consecutive days. The net outflow of main computer funds exceeded 8 billion yuan, the net outflow of non-bank finance exceeded 4.8 billion yuan and the net outflow of banks exceeded 2.6 billion yuan.

Looking forward to the market outlook, Huatai Securities pointed out that in the past, the market interpretation from the two sessions to the end of April depended on the change of profit expectations. However, considering the impact of the production cycle and the real estate cycle, the improvement of profit still needs to be observed in the short term, and the short-term market probability is still structural. The technology that resonates with the industrial cycle and the policy cycle is the main direction. The current technology market is significantly catalyzed by events, and the subsequent GTC conference, Tencent Financial Report and Huawei China Partner Conference are all important observation windows. Overall, there is still room in March, and we can be cautious in April.

Yingda Securities said that it will enter the intensive disclosure period of the annual report from mid-to-late March to April, and the degree of corporate profit redemption will become the touchstone. The current market valuation of the robot industry and AI sector has reflected expectations, but whether the performance of some targets can match the high valuation is uncertain, so we need to be alert to the callback risk (although we are still optimistic about the performance of technology stocks in the medium and long term, there may be shocks after the short-term continuous rise, reminding investors to pay attention to the rhythm). Sectors with stable cash flow such as consumption and medicine may be favored because of their defensive attributes.

In terms of market hotspots, pharmaceutical bio-stocks strengthened across the board, with pharmaceutical commerce, AI medical care, family doctors, medical beauty, etc. among them, the index of innovative drugs, diet pills and other sectors hit new highs in the year. People’s Tongtai, Jianzhijia, Saili Medical, Runda Medical and other batch daily limit.

Following the first mention of "innovative drugs" in the government work report in 2024, this year’s government work report once again proposed to improve the drug price formation mechanism, formulate a list of innovative drugs, and support the development of innovative drugs.

With the continuous blessing of policies, innovative drugs in China have developed steadily. According to the statistics of Huatai Securities, since 2025, the number of foreign authorized transactions of domestic innovative drugs has reached 22, a year-on-year increase of 29%; The total amount of transactions disclosed was $10.183 billion, which was basically the same as that of the same period last year. On the other hand, in the global market, there were 110 innovative drug transactions in the same period, the number increased by 3% year-on-year, but the total amount disclosed was 19.973 billion US dollars, down by 14% year-on-year.

Recently, a number of A-share pharmaceutical listed companies have launched fixed-income plans to increase investment in innovative drugs. Today, Bailey Tianheng announced that the company plans to issue no more than 20.05 million shares to specific targets, and the total amount of funds raised will not exceed 3.9 billion yuan. After deducting the issuance expenses, all of them will be used for innovative drug research and development projects to promote the research and development process of the company’s bio-innovative drug product pipeline. Haisike and Dizhe Medicine also announced that they will increase their funds for new drug research and development projects.

Century Securities said that the valuation of high-potential innovative pipelines by investment institutions and overseas pharmaceutical companies is showing signs of warming, and the valuation of early innovative pipelines by the entire innovative pharmaceutical sector is expected to be reconstructed. At present, BD has not been completed, and Biotech, which has made rapid clinical progress, is more hopeful to benefit from this round of valuation reconstruction.